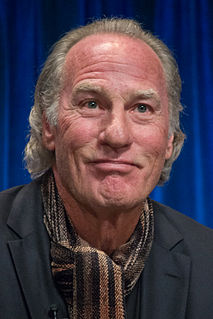

A Quote by Craig T. Nelson

California is no longer a state, it's a hedge fund.

Quote Topics

Related Quotes

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

When a hedge-fund guy gets lucky because the market goes up, and he is going to make $200m, and you know $200 million, and he is going to pay almost no tax. I don't think that is a good thing for the country, and they are all supporting Jeb Bush and Hillary Clinton, all the hedge-fund guys. I don't want their support, because I'm totally self-funding my campaign.

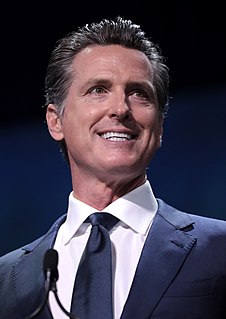

Virtually throughout its history, and certainly in the 20th century, California has been known as the place to go for dynamism and growth. It did not become the richest, most populous, and most productive state solely because of its weather and natural resources. So it takes a lot to turn California around from growth to contraction, from people moving into the state to a net exodus from the state, from business moving into California to businesses leaving California. It takes some doing. And the Left has done it.

The big advantage that we have as a venture capital firm over a hedge fund or a mutual fund is we have a 13-year lockup on our money. And so enterprise can go in and out of fashion four different times, and we can go and invest in one of these companies, and it's okay, because we can stay the course.