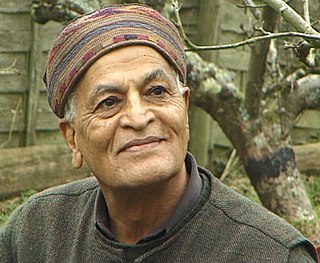

A Quote by Daisaku Ikeda

Instead of engaging in cutthroat competition, we should strive to create value. In economic terms, this means a transition from a consumer economy - the mad rush for ownership and consumption - to a constructive economy where all human beings can participate in the act of creating lasting worth.

Related Quotes

As more and more people are automated out of the economy through robotics and self-driving cars and other technologies, there will be a way to create value for other human beings online. There will be a virtual economy for exchanging value, goods and services, entertainment experiences, and all that.

Above all, we should question the consumer ethic, which uses up non-renewable resources, creates inequality and injustice, generates pollution, destroys other species and upsets the balance of nature. The consumer ethic not only defiles the environment by creating undesirable change in the biosphere but also corrupts the mind and body by defining pleasure in terms of ownership and absorption. Waste itself is a human concept; everything in nature is eventually used. If human beings carry on in their present ways, they will one day be recycled along with the dinosaurs.

Roughly two billion people participate in the money economy, with less than half of those living in the wealthy countries of the developed world. These affluent 800 million, however, account for more than 75 percent of the world's energy and resource consumption, and also create the bulk of its industrial, toxic, and consumer waste.

The illusion that consumption - and its correlative, income - is desirable probably stems from too great preoccupation with what Knight calls "one-use goods," such as food and fuel, where the utilization and consumption of the good are tightly bound together in a single act or event. ... any economy in the consumption of fuel that enables us to maintain warmth or to generate power with lessened consumption again leaves us better off. ... there is no great value in consumption itself.

Today it's fashionable to talk about the New Economy, or the Information Economy, or the Knowledge Economy. But when I think about the imperatives of this market, I view today's economy as the Value Economy. Adding value has become more than just a sound business principle; it is both the common denominator and the competitive edge.

We have created new idols. The worship of the ancient golden calf (cf. Ex 32:1-35) has returned in a new and ruthless guise in the idolatry of money and the dictatorship of an impersonal economy lacking a truly human purpose. The worldwide crisis affecting finance and the economy lays bare their imbalances and, above all, their lack of real concern for human beings; man is reduced to one of his needs alone: consumption.

There are many ways to create economic suicide on a national level. The major way through history has been through indebting the economy. Debt always expands to reach a point where it cannot be paid by a large swathe of the economy. This is the point where austerity is imposed and ownership of wealth polarizes between the One Percent and the 99 Percent.

We need to remake and reinvent our housing system so that it supports the flexibility and mobility of our economic system broadly. Home-ownership is rewarded by the federal tax code, which made great sense when that piece of the American Dream, and all the consumption that came with it, was essential to rebuilding the economy. These days, however, it feels like a huge penalty to people who want to travel light within the new mobile economy without a mortgage to hold them back.

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

This new economy that's just emerged has a new central economic actor. It's not the worker, the person who produces, nor the person who consumes, the purchaser. It's a new actor that does both things at the same time, call them a creator. They both create and consume in the same single act, and we're just beginning to see the shape of this new economy and it changes not just the economy itself, it's going to change the whole nature of the work relationship.

Our consumer-oriented economy wouldn't survive without economic growth. The whole mechanism depends on invention and insinuation of novelties, arousing new wants, seduction and temptation. This is the problem we face - much more than recapitalizing the banks. The question is: Is that kind of economy sustainable?