A Quote by Dan Ariely

The problem is that people basically dangle debt in front of us. And the cost for the poor of course is much higher than for the wealthy.

Related Quotes

The companies that provide debt, what do you think their goal is? Is their goal for you to fully understand the cost of your debt? No. So they're basically creating these approaches to make you feel like it is incredibly cheap or just to think about the cost per day rather the cost per year or cost for a lifetime. So debt is very simple mistake.

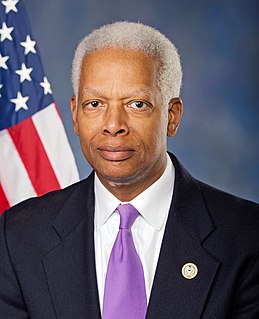

The growing inequality of wealth and income distribution is both a moral and economic problem. If the wealthy are unwilling to pay more taxes, then this is going to lead to spending cuts. And if you put off the table things like national defense, then you're going to end up cutting more and more out of programs that aid the poor. So, I think there are consequences to this idea that tolerance for inequality requires us to - to just do nothing to make the wealthy contribute a higher share of resources to fund the government.

Jesus refers to the poor over and over again. There are 2,000 verses of Scripture that call upon us to respond to the needs of the poor. And yet, I find that when Christians talked about values in this last election that was not on the agenda, that was not a concern. If you were to get the voter guide of the Christian Coalition, that does not rate. They talk more about tax cuts for people who are wealthy than they do about helping poor people who are in desperate straits.

Have a great compassion for people. To be able to have a heart full of compassion, we need to pray. Especially be kind, be loving to the poor. We think we do so much for the poor, but it is they who make us rich. We are in debt to them. Do you want to do something beautiful for God? There is a person who needs you. This is your chance.

People think of a business cycle, which is a boom followed by a recession and then automatic stabilizers revive the economy. But this time we can't revive. The reason is that every recovery since 1945 has begun with a higher, and higher level of debt. The debt is so high now, that since 2008 we've been in what I call, debt deflation.

If you look at a farmer and his daily expenditure on existing energy services, it is much higher on an incremental delta basis. And then there is an emotional cost of not providing their kids with the right to educate. If you calculate these costs in economic terms and create a financing mechanism for them to buy it, the emotional delta cost is much higher compared to their household.

Keynesian modelling relies on marginal propensity to consume and marginal propensity to invest. The idea that if we give more money to the poor, they have a propensity to consume that's much higher than the wealthy, though I wish they would talk to my wife about that; she seems to have a propensity to consume.

Italy may well be the main problem. It has benefited most from the euro by having been able to get the euro interest rate instead of what otherwise would have been its own. That would be much higher because Italy has been accumulating so much debt. In the past, Italy has inflated away its debt. The virtue of the euro is that Italy can't do it alone. A tight ECB policy wouldn't permit that to happen again.