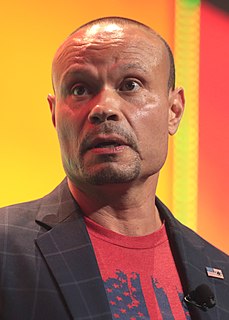

A Quote by Dan Bongino

If we had a flat tax code rather than a 70,000-page document full of cronyism and favors, bureaucrats and elected officials wouldn't have the power to do you any favors. That's what we need. You would have to compete on your own on a level playing field, but that's not what the government permits now.

Related Quotes

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

Ask a fellow if he favors organized prayer in the public schools. If he says 'No' he's a liberal. If he says 'Yes' he's a conservative. If he says, 'Public schools? The Constitution grants the government no power to run any mandatory tax-funded youth propaganda camps,' you have your hands on the wily libertarian.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

As to the kindness you mention, I wish I could have been of more service to you than I have been, but if I had, the only thanks that I should desire are that you would always be ready to serve any other person that may need your assistance, and so let good offices go around, for humankind are all of a family. As for my own part, when I am employed in serving others I do not look upon myself as conferring favors but paying debts.