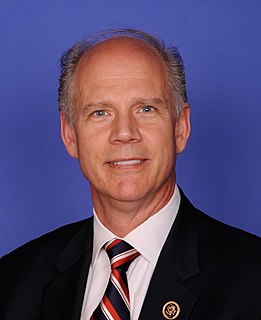

A Quote by Dan Donovan

I wanted nothing more than to vote for a tax plan that would put more money in the pockets of overburdened taxpayers and spur job creation.

Related Quotes

Republican leaders have made clear they have no plans to use the power of government to stimulate the economy, invest in job creation and spur job growth. The Fed's plan is to give banks more money to finance the private sector job creation. But banks have ample cash now; they aren't lending, and the private sector is not creating the jobs. That is why we have 15 million people unemployed.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

We're talking about should we increase taxes? Why not put a tax on carbon emissions. It would raise a lot of money, it would reduce the environmental damages in the future, it would solve so many problems, and it would be a much more constructive thing to do than to think about raising the income tax.

When a man tells you that he got rich through hard work, ask him whose. There's no evidence that more people with more skills would produce more jobs. There's a great deal of evidence that they produce more competition for the jobs that exist, and in turn, drive down the cost of labour. Nothing pleases a corporation more than having five people compete for the same job. Competitiveness means good times for machines, not workers, because our tax systems privilege machines over workers.A lost job can put a smile on any shareholder's face.

It's tax day and while many Americans are filing their taxes with a groan, taxpayers in the Badger State have reason to cheer. In Wisconsin, we have enacted more than $2 billion in tax cuts, giving our citizens much-needed relief, call us crazy Midwesterners but we think you know how to spend your money better than the government.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.