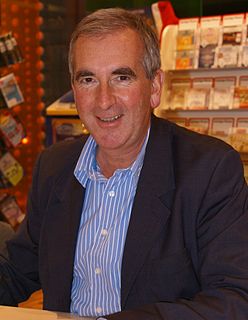

A Quote by Dan Gilbert

The efficiency, credibility, and liquidity of the financial markets have been foundational to the largest economy in the world.

Related Quotes

In Germany it is good if as many people as possible join initiatives and peaceful demonstrations against the rule of the financial markets. Worshipping the unfettered freedom of global markets has brought the world to the brink of ruin. We now need social and ecological rules for the market economy.