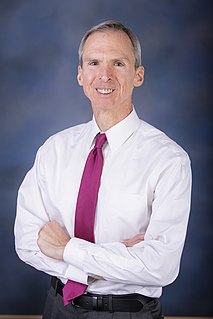

A Quote by Dan Lipinski

All tax incentives do is make it cheaper to borrow for transportation projects. But you still have to pay that money back.

Related Quotes

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.