A Quote by Dan Schulman

I think a lot of people have predicted the demise of cash, and they've frequently been wrong. But there's no question that the smartphone is leading to the digitization of money. You really now have all the power of a bank branch in the palm of your hand.

Related Quotes

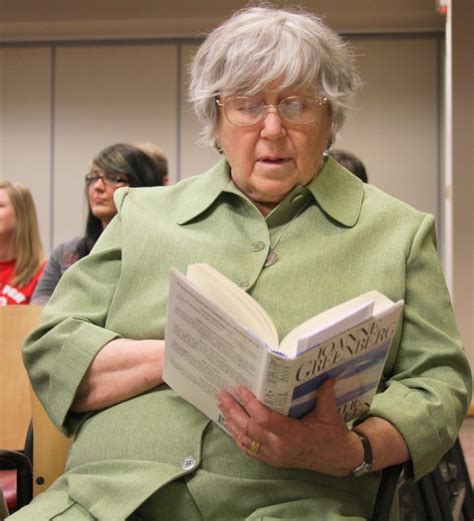

Under the old system - which is now so archaic that a lot of people can't remember it - if you wanted money you had to go to the bank and take the money out in cash form, and you couldn't take out money that you didn't have. But with the credit card you can spend money you don't have, and that is just so tempting.

JPMorgan was already, for the most part. Our businesses at JPMorgan share the same cash-management systems. The commercial bank, the private bank, the retail bank, they all use the branches. The cash-management system moves the money around the world - for global corporations, and for you, the consumer, too.

What happened was that for every $100 of money, by which I mean the cash that people keep in their pockets, and the deposits they have in the bank, for every $100 of money that there was in 1929, by 1933 there was only $67. The Federal Reserve allowed the quantity of money to decline by a third. While, at all times, it had the possibilities and the power of preventing that from happening.

Great people in the United States have been disenfranchised.I'll give you an example, it has always been the way to do it, to work hard, save your money, put your money in the bank, get interest on your money and retire wealthy, at least modestly wealthy. Well, the people that have done that have been hurt terribly because there is no interest on your money. You get no money. I just signed for some CDs where you are getting a quarter of one percent. A quarter of one percent! They don't even want your money, the banks.

If you have loans, the first thing you want to do is say, "Okay, look I have a credit card, if I really need to borrow, I have this emergency money that I can get, but for now there is no reason for me to keep cash at zero percent interest rate and at the same time, pay all of this money out. So, I think people need to figure out quickly how to pay loans and how much cash they should really keep.

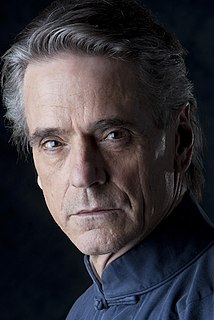

People at civil-liberties organizations say it's a sea change, and that it's very clear judges have begun to question more critically assertions made by the executive. Even though it seems so obvious now, it is extraordinary in the context of the last decade, because courts had simply said they were not the best branch to adjudicate these claims - which is completely wrong, because they are the only nonpolitical branch. They are the branch that is specifically charged with deciding issues that cannot be impartially decided by politicians.

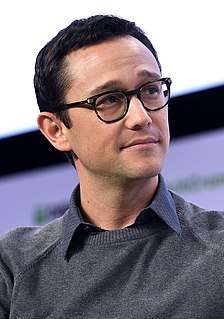

Corporations are legal fictions created by the State to shield executives from liability… It’s like if I had a little hand-puppet, and I went to rob a bank, and the hand-puppet held the little gun and told people to hand over all the money, and then the hand-puppet grabbed the money and ran out, and then I got caught and I handed the hand-puppet over the police and then the police tried the hand-puppet, put the hand-puppet in jail, and I get to keep all the money.

A lot of people, most people who are working, they do it for money. And I'm not saying there's anything wrong with that. It so happens that I made a lot of money already, so I don't have to worry that much about it. I wouldn't fault anybody for doing it for the money, but it doesn't interest me right now.

At the base of the Fed pyramid, and therefore of the bank system's creation of "money" in the sense of deposits, is the Fed's power to print legal tender money. But the Fed tries its best not to print cash but rather to "print" or create demand deposits, checking deposits, out of thin air, since its demand deposits constitute the reserves on top of which the commercial banks can pyramid a multiple creation of bank deposits, or "checkbook money."

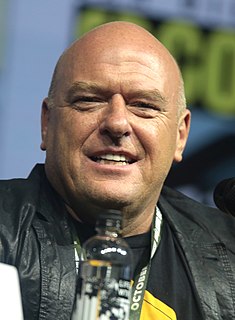

I talked to people that I'd done theater with, older actors and stuff. There's a lot of people who go into the business, and they must think they're good, or they wouldn't be in it. Why do you think that you're good enough to go into the business and make money at it? So I really wanted to ask myself that question a lot. Because it was an important kind of thing that I was going to do. I really wanted to do it, I loved it, and I thought that I was good enough that I could make money at it. And that's really what it came down to.