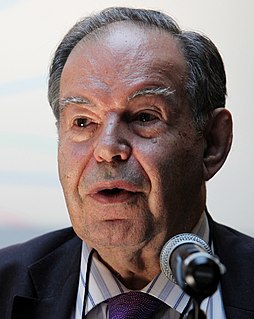

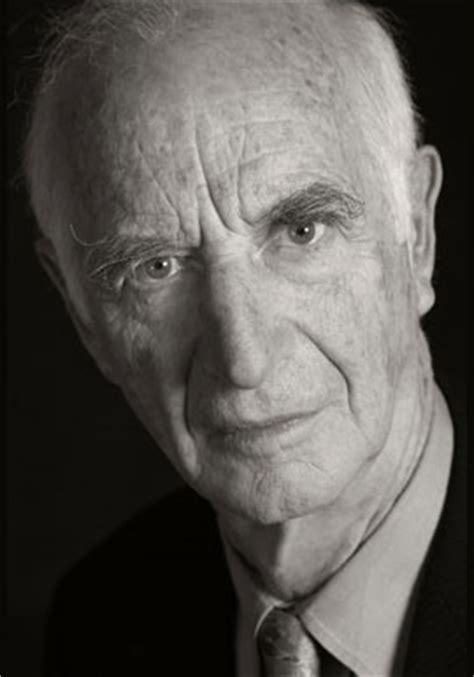

A Quote by Daniel Kahneman

The illusion of skill is not only an individual aberration; it is deeply ingrained in the culture of the [investment management] industry.

Related Quotes

The culture of the mutual fund industry, when I came into it in 1951, was pretty much a culture of fiduciary duty and investment, with funds run by investment professionals. The firm I worked with, Wellington Management Co., they had one fund. That was very typical in the industry... investment professionals focused on long-term investing.

Invest in low-turnover, passively managed index funds... and stay away from profit-driven investment management organizations... The mutual fund industry is a colossal failure... resulting from its systematic exploitation of individual investors... as funds extract enormous sums from investors in exchange for providing a shocking disservice... Excessive management fees take their toll, and manager profits dominate fiduciary responsibility.

In investment management today, everybody wants not only to win, but to have a yearly outcome path that never diverges very much from a standard path except on the upside. Well, that is a very artificial, crazy construct. That's the equivalent in investment management to the custom of binding the feet of Chinese women

The management of creativity is more intimate. By that I mean that it deals with an individual's personal, psychological landscape. It deals with the way you create relationships. It deals with creating an atmosphere and environment that support the creative process. As a result, it is a management skill set that is inherently psychological and that encourages desired outcomes rather than demands those outcomes.

I am extremely honoured by Indian Council For Culture Relations, India's apex body on the promotion of great Indian culture across the world for including cinema and I am deeply honoured for being the first person from the Indian film industry to represent the cause of this industry in the overall cultural promotion globally.

The only way to make something cheaply today is to have it mass-produced. For example, you wear the same shoes as everyone else. If you had a fabber, you could custom-make shoes that perfectly fit your feet. Three-dimensional printing will help us move away from the mass consumption that is so deeply ingrained in our culture.