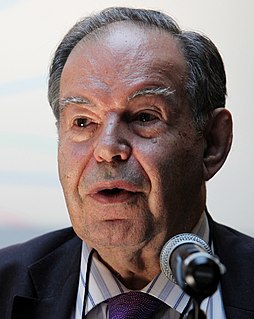

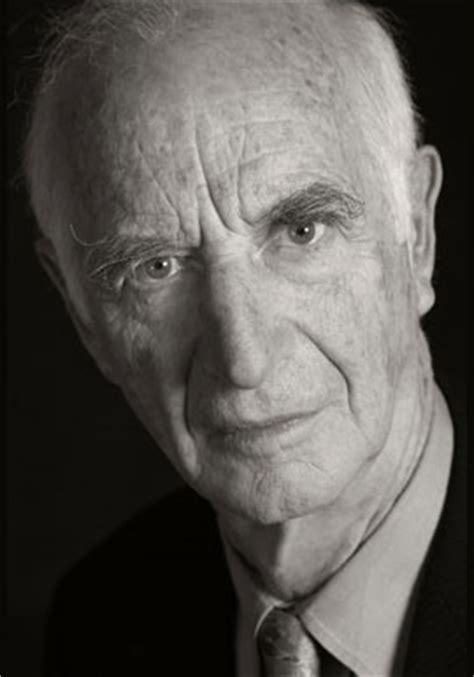

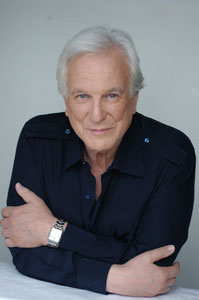

A Quote by Daniel Kahneman

Individual investors predictably flock to stocks in companies that are in the news.

Related Quotes

Investors have to remember: corporate profits are going up, but stocks are going up faster. How can that continue indefinitely? Investors can only earn what companies themselves can earn; the government or the markets themselves don't kick anything in. How can you get anything more out of a farm than what it grows?

One of the great strengths of American culture is this empowerment of individual, is the individual being able to be entrepreneurial, create new things. But you create a whole group of people to make great companies. It's employees and investors and customers and partners. The fabric of society, of a network of relations, is key to being successful.

While I take no pleasure in others' misfortunes, we've historically made most of our profits from other investors behaving in a panicked and irrational fashion and selling us certain stocks at prices far below their intrinsic value. More volatility equals cheaper stocks, which equals higher returns.

'Ick investing' means taking a special analytical interest in stocks that inspire a first reaction of 'ick.' I tend to become interested in stocks that by their very names or circumstances inspire unwillingness - and an 'ick' accompanied by a wrinkle of the nose on the part of most investors to delve any further.

There's no use diversifying into unknown companies just for the sake of diversity. A foolish diversity is the hobgoblin of small investors. That said, it isn't safe to own just one stock, because in spite of your best efforts, the one you choose might be the victim of unforeseen circumstances. In small portfolios, I'd be comfortable owning between three and ten stocks.