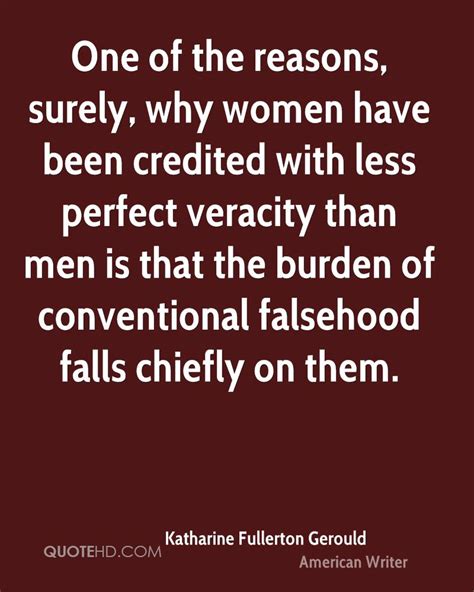

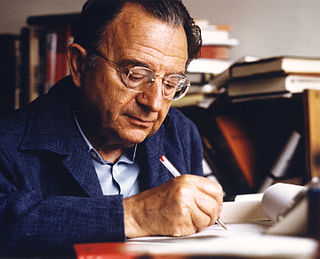

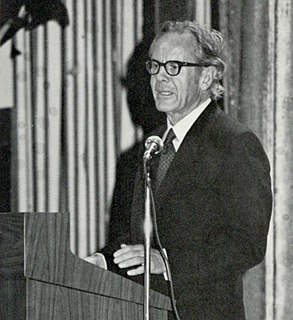

A Quote by Daniel Kahneman

There are domains in which expertise is not possible. Stock picking is a good example. And in long-term political strategic forecasting, it's been shown that experts are just not better than a dice-throwing monkey.

Related Quotes

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

... there are some who, believing that all is for the best in the best of possible worlds, and that to-morrow is necessarily better than to-day, may think that if culture is a good thing we shall infallibly be found to have more of it that we had a generation since; and that if we can be shown not to have more of it, it can be shown not to be worth seeking.

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.