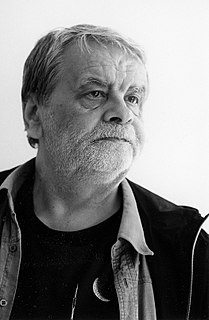

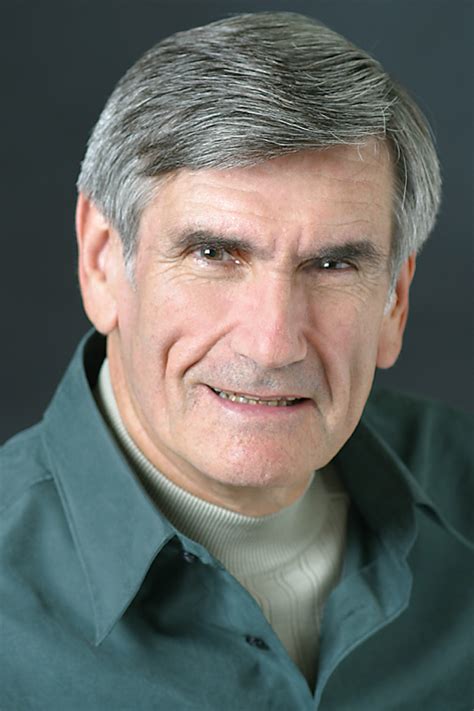

A Quote by Daniel Kahneman

There's a tendency to look at investments in isolation. Investors focus on the risk of individual securities.

Quote Topics

Related Quotes

There is a natural tendency for investors to devote a significant majority of their time to finding new ideas. After all, uncovering great companies selling at great prices is the lifeblood of successful investing. But in the never-ending quest for the next great idea, investors often give short shrift to their existing investments.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.

[Kierkegaard] did not care for large public events because every crowd is in itself an untruth. The only way out is isolation, aloofness. Only the individual is a reality and only the individual is true. Maybe the process of isolation in an individual is one of the most important matters that exists. Is not the whole point of this world for people to separate and become individuals?

I mean, these good folks are revolutionizing how businesses conduct their business. And, like them, I am very optimistic about our position in the world and about its influence on the United States. We're concerned about the short-term economic news, but long-term I'm optimistic. And so, I hope investors, you know - secondly, I hope investors hold investments for periods of time - that I've always found the best investments are those that you salt away based on economics.

If we're talking about buying exchanges abroad, we have to have global securities standards, as we have global banking regulations. I'm talking about margins. Now, the United States has certain margin requirements that are not the same in London. Investors and hedge funds that want to borrow more money against securities ? if they can't in the U.S., they go abroad. That could add additional risks to the global economy.

Governments must address inconsistencies in their energy strategies, consider the links with broader economic policies, and stop sending mixed signals to consumers, producers, and investors. In particular, they must assess whether the right regulatory arrangements are in place to allow clean-energy investments to compete on a risk-return basis.