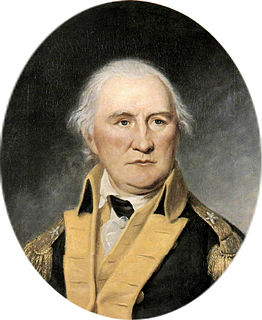

A Quote by Daniel Morgan

We know that government intervention in the free market, and Argentine history has shown this, absolutely ends in a boomerang.

Related Quotes

There is still a tendency to regard any existing government intervention as desirable, to attribute all evils to the market, and to evaluate new proposals for government control in their ideal form, as they might work if run by able, disinterested men free from the pressure of special interest groups.

In the whole history of capitalism, no one has been able to establish a coercive monopoly by means of competition in a free market...Every single coercive monopoly that exists or ever has existed...was created and made possible only by an act of government...which granted special privileges (not obtainable in a free market) to a man or a group of men, and forbade all others to enter that particular field.

I started out by viewing the marketplace as a cruel place, where you need intervention by government and lawyers to protect people. But after watching the regulators work, I have come to believe that markets are magical and the best protectors of the consumer. It is my job to explain the beauties of the free market.

The larger the government, the more our livings standards are reduced. We are fortunate as a civilization that the progress of free enterprise generally outpaces the regress of government growth, for, if that were not the case, we would be poorer each year - not just in relative terms, but absolutely poorer too. The market is smart and the government is dumb, and to these attributes do we owe the whole of our economic well-being.

One of the great things about a free market is that it's inherently and indefatigably Darwinistic. Left to its own devices, a free market will eventually weed out the stupid from both 'ends' of the food chain otherwise described as supply and demand. As money is liberated from the hands of the stupid, those who would sell products or services to the stupid will eventually lose their share of the marketplace. Devoid of any 'benevolent' interference from government, the process is gloriously relentless, and cannot help but yield a successively smarter class of participants.

If, for example, existing government intervention is minor, we shall attach a smaller weight to the negative effect of additional government intervention. This is an important reason why many earlier liberals, like Henry Simons, writing at a time when government was small by today's standards, were willing to have government undertake activities that today's liberals would not accept now that government has become so overgrown.