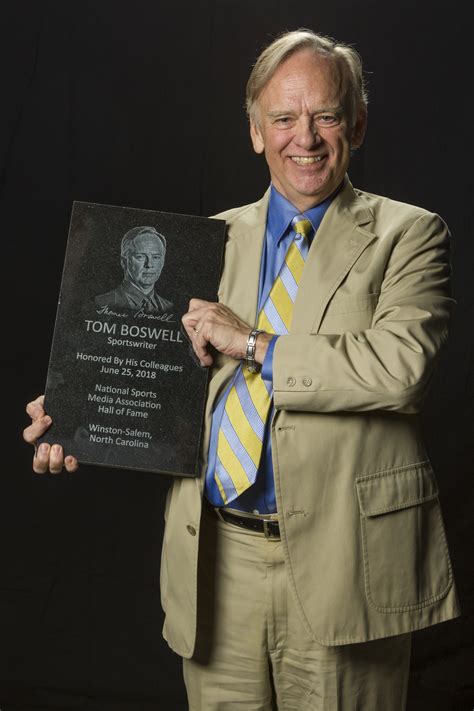

A Quote by Daniel Seligman

Net result [of the Dept. of Agriculture's Payment in Kind - PIK - program]: total farm income, now expected to be around $25 billion, this fiscal year, will exceed total federal subsidies by only a couple of billion. You could argue that those fellows out there on the fruited plain are in effect working for the federal government and that, therefore, the U.S. now has socialized agriculture under the Reagan Administration. Rich, eh?

Related Quotes

During the fiscal year ending in 1861, expenses of the federal government had been $67 million. After the first year of armed conflict they were $475 million and, by 1865, had risen to one billion, three-hundred million dollars. On the income side of the ledger, taxes covered only about eleven per cent of that figure. By the end of the war, the deficit had risen to $2.61 billion. That money had to come from somewhere.

This is not some alarmist Orwellian scenario; it is here, now, financed by $20 billion last year and $15 billion more this year of federal money appropriated out of sheer fear. By creating the means to monitor 300 million visits to the United States yearly, this administration and a supine opposition are building a system capable of identifying, tracking and spying on 300 million Americans.

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

Corn is already the most subsidized crop in America, raking in a total of $51 billion in federal handouts between 1995 and 2005 - twice as much as wheat subsidies and four times as much as soybeans. Ethanol itself is propped up by hefty subsidies, including a fifty-one-cent-per-gallon tax allowance for refiners.

Just look at that Forbes 400. Takes a billion three to get on the Forbes 400 this year. And the aggregate wealth is just staggering. And those people are paying less percentage of their total income to the federal government than their receptionists are. [...] I'll bet a million dollars against any member of the Forbes 400 who challenges - me that the average for the Forbes 400 will be less than the average of their receptionists.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

Does it sound outrageous to you that military spending for fiscal year 2000 will be almost $290 billion and all other domestic discretionary spending, such as education, job training, housing, Amtrak, medical research, environment, Head Start and many other worthwhile programs will total $246 billion, the biggest disparity in modern times ?