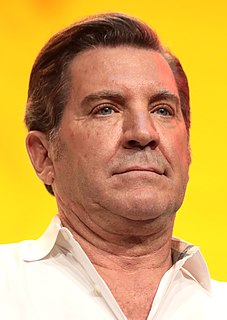

A Quote by Daniel Yergin

If a war started, the oil price probably would go up, as you said, maybe $5, $6 a barrel until you saw other oil from the extra supplies that are available elsewhere coming into the world, into the market.

Related Quotes

Over time, there's a very close correlation between what happens to the dollar and what happens to the price of oil. When the dollar gets week, the price of oil, which, as you know, and other commodities are denominated in dollars, they go up. We saw it in the '70s, when the dollar was savagely weakened.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

I've been saying for a long time, and I think you'll agree, because I said it to you once, had we taken the oil - and we should have taken the oil - ISIS would not have been able to form either, because the oil was their primary source of income. And now they have the oil all over the place, including the oil - a lot of the oil in Libya, which was another one of her disasters.

I do not remember when I said this [oil production would collapse ], maybe in the heat of the moment, but I do not think I even said it, but I may just not remember it. I was saying that at a certain level of oil prices new deposits will not be explored. That is what is actually happening. However, surprisingly, our oil and gas workers [mainly oilmen] continue to invest.