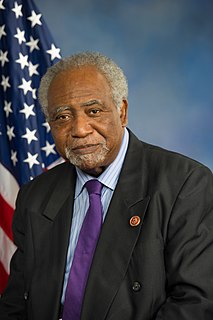

A Quote by Danny K. Davis

Some of the huge tax breaks that we gave to the wealthiest 1 percent of the population in this country during the Bush era have contributed significantly to the deficit.

Related Quotes

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate revenues and a restricted economy; or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve -- and I believe this can be done -- a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

If we choose to keep those tax breaks for millionaires and billionaires, if we choose to keep a tax break for corporate jet owners, if we choose to keep tax breaks for oil and gas companies that are making hundreds of billions of dollars, then that means we've got to cut some kids off from getting a college scholarship.

The US is a country [in which] eighty percent of the population thinks the Bible was written by god. About half think every word is literally true. So it's had to appeal to that - and to the nativist population, the people that are frightened, have always been... It's a very frightened country and that's increasing now with the recognition that the white population is going to be a minority pretty soon, "they've taken our country from us."