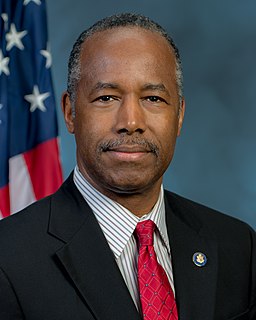

A Quote by Darryl Glenn

Better educating our college students on the risks of high student debt and helping them to find alternatives to taking out student loans would help make the difference to their financial future.

Related Quotes

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

When the students were asked to identify their race on a pretest questionnaire, that simple act was sufficient to prime them with all the negative stereotypes associated with African Americans and academic achievement. If a white student from a prestigious private high school gets a higher SAT score than a black student from an inner-city school, is it because she’s truly a better student, or is it because to be white and to attend a prestigious high school is to be constantly primed with the idea of “smart”?