A Quote by Dave Barry

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.

Quote Topics

Related Quotes

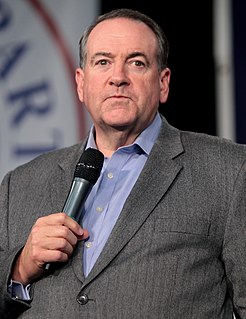

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.

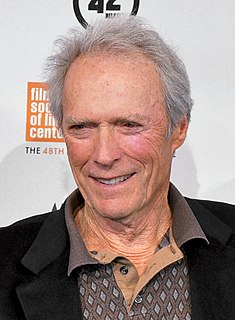

I guess it's like trying to put through the flat tax, which is probably my favorite one of all.... if we did pass it, all of a sudden, what do you have? You have the whole tax system run by a little old lady on a home computer, doing the work of all these thousands of bureaucrats and accountants. Passing that would be amazing, wouldn't it?

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

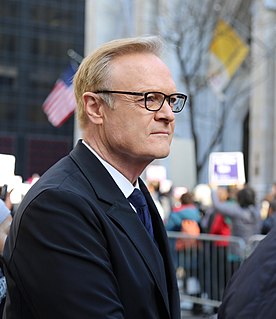

I don't think this is a situation where you can say that Congress was avoiding any mention of the tax power. It'd be one thing if Congress explicitly disavowed an exercise of the tax power. But given that it hasn't done so, it seems to me that it's - not only is it fair to read this as an exercise of the tax power, but this court has got an obligation to construe it as an exercise of the tax power if it can be upheld on that basis.