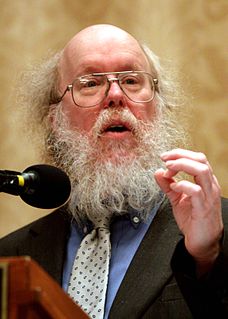

A Quote by Dave Barry

I'm not the only taxpayer who has no idea what he's sending to the IRS. This year, only 28 percent of all Americans will prepare their own tax returns, according to a voice in my head that invents accurate-sounding statistics.

Related Quotes

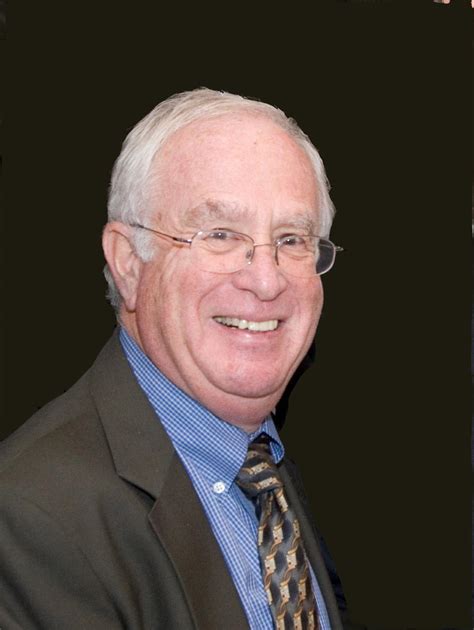

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

Unreason is now ascendant in the United States - in our schools, in our courts, and in each branch of the federal government. Only 28 percent of Americans believe in evolution; 68 percent believe in Satan. Ignorance in this degree, concentrated in both the head and belly of a lumbering superpower, is now a problem for the entire world.

I had nothing to do with death panels. I thought it was a horrible phrase about end of life. I didn't think it was accurate, and I was - I've always been opposed to it. The reason why I stood behind that phrase "death tax" for so many years is because the only time that you could pay that tax, the only time, is on the death of a relative. And that's what makes it a death tax. You have to be accurate.

Trump often says he needs to keep his tax returns private until the IRS finishes auditing him. But the IRS itself has said this isn't necessary. And recently, Trump changed his tune, saying he'll release his returns as soon as Hillary Clinton releases the 33,000 emails she deleted from her email server.

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

There is no tax policy that better describes how out of touch America's liberals are with the rest of the country than the estate tax. According to the Left, government seizure of a large share of the wealth of an American taxpayer is a moral imperative that serves social justice. Most Americans disagree, big time.

Eighty five percent of Americans, year in and year out, say they believe everyone should have universal coverage. The problem is everybody has a different idea of how to make it work. And unfortunately what you have is 85 percent of Americans are reasonably well-insured. And when you start thinking about how you're going to get the remaining 15 percent, everyone gets very nervous.

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.