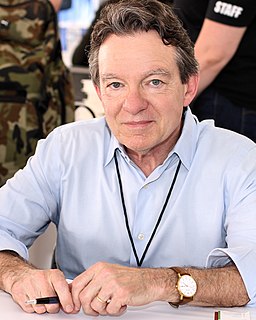

A Quote by Dave Barry

The IRS spends God knows how much of your tax money on these toll-free information hotlines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly.

Related Quotes

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

Churches are tax exempt because they are supposed to provide a public good. To prove that good to the IRS, churches arent supposed to hoard their money. They are supposed to spend it on goods and services for the faithful. Under this pretense, the church has made massive investments in tax free real estate all over the world. And when it comes to labor costs, they are almost free.

It turns out a VAT - a value-added tax - is a very easy tax to collect and a very hard tax to evade. It's a really good idea. It was invented about 60 years ago in France, of course. Because they're so good at taxing. They had a business tax that was easy to evade, and the head of the French IRS invented this value-added tax, which is very hard to evade.

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

'The Committee has identified eight senior leaders who were in a position to prevent or to stop the IRS's targeting of conservative applicants,' the Oversight report states. 'Each of these leaders could have and should have done more to prevent the IRS's targeting of conservative tax-exempt applicants.'

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.