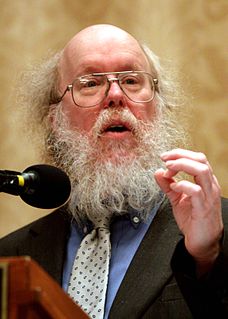

A Quote by Dave Barry

When I write my annual tax column, some ex-IRS agent will complain, "There you go IRS bashing again." They're always saying that they're just doing their job. Someone I know once said, "You could get another job."

Related Quotes

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

I had a teacher who said something great. That was, 'Go out and collect your nos. Once you get fifty nos then you can start wondering when you can get a yes.' He said, 'It is not your job to get the job; its your job to do a consistent body of work. So, every time you go in there, just go in there and be consistent, and eventually it will get noticed and someone will hire you.'

Trump often says he needs to keep his tax returns private until the IRS finishes auditing him. But the IRS itself has said this isn't necessary. And recently, Trump changed his tune, saying he'll release his returns as soon as Hillary Clinton releases the 33,000 emails she deleted from her email server.

Every year I write a tax advice column and I used to always make fun of that. One year, one of my favorite IRS commissioners, I think his name was Roscoe somebody, wrote that one of the most often-asked questions by taxpayers was, "How can I contribute more?" Well, I tell ya, ol' Roscoe's really been doing situps under parked cars again. I've heard a lot of people ask a lot of questions about taxes, but I never heard anybody say, "How can I, the ordinary person, send more money for no reason?"

'The Committee has identified eight senior leaders who were in a position to prevent or to stop the IRS's targeting of conservative applicants,' the Oversight report states. 'Each of these leaders could have and should have done more to prevent the IRS's targeting of conservative tax-exempt applicants.'

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.

Every time you say yes to something you don’t want to do, this will happen: you will resent people, you will do a bad job, you will have less energy for the things you were doing a good job on, you will make less money, and yet another small percentage of your life will be used up, burned up, a smoke signal to the future saying, “I did it again.