A Quote by Dave Ramsey

When getting help with money, whether it is insurance, real estate or investments you should always look for a person with the heart of a teacher, not the heart of a salesman.

Related Quotes

Look with your heart and not with your eyes. The heart understands. The heart never lies. Believe what it feels, and trust what it shows. Look with your heart; the heart always knows. Love is not always beautiful, not at the start. But open your arms, and close your eyes tight. Look with your heart and when it finds love, your heart will be right.

Heart weeps. Head tries to help heart. Head tells heart how it is, again: You will lose the ones you love. They will all go. But even the earth will go, someday. Heart feels better, then. But the words of head do not remain long in the ears of heart. Heart is so new to this. I want them back, says heart. Head is all heart has. Help, head. Help heart.

The business side of real estate investing is fraught with risk. Unlike purchasing mutual funds or savings bonds, with real estate, you can lose money; this is one of the reasons that seasoned real estate investors caution neophytes never to get too emotional about a property and always be willing to walk away.

Above all else, be true to your heart. When you marry, whether it be a marquis or an estate manager (or both!), it will be for life. You must go where your heart leads and never forget that love is the most precious gift of all. Money and social status are poor substitutes for a warm, tender embrace, and there is little in life more fulfilling than the joy of loving and knowledge that you are loved in return.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?

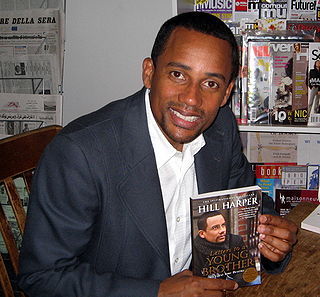

A lot of the stuff that's happening now, I can trace back to 'Death of a Salesman.' Francine Maisler, the casting director, saw 'Death of a Salesman' and called me in for 'Unbroken.' The casting director of 'Normal Heart' had seen 'Salesman' too. I look back on it now, and it's like one thing led to another; it was a chain reaction.

What went wrong is we had tremendous concentration in the sense we put a lot of our money to work against U.S. real estate. We got here by lending money, and putting money to work in the U.S. real estate market, in a size that was probably larger than what we ought to have done on a diversification basis.