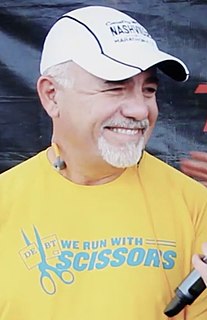

A Quote by Dave Ramsey

Never take a loan against your retirement! When you pay interest against your retirement, you cost yourself interest.

Quote Topics

Related Quotes

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

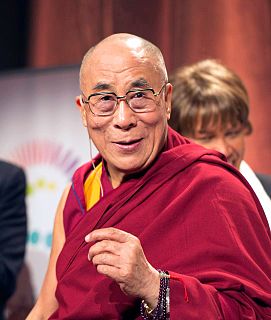

There is no self-interest completely unrelated to others' interests. Due to the fundamental interconnectedness which lies at the heart of reality, your interest is also my interest. From this it becomes clear that "my" interest and "your" interest are intimately connected. In a deep sense, they converge.

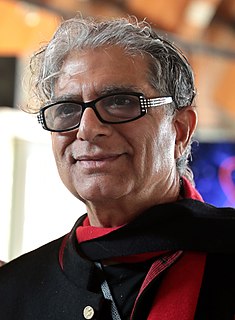

People look at things differently. Imagine going to a village in Southern Sudan and try to explain to someone there the concept of life insurance or retirement. Go to Vietnam and say retirement. Retirement in another country is your body is too racked with pain and your hands are too arthritic from the life in the rice patty fields, so you can't work anymore. So you move in with your son and his new wife takes care of you because that's how families work there.