A Quote by David Bonderman

A good default, like Portugal or Greece, would be very good for the private equity business.

Related Quotes

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

Nobody in my generation ever started out in private equity. We got there by accident. There was no private equity business - actually, the word didn't even exist - when I started. I got there out of the purest of happenstance and so I think many people find what they really enjoy doing just in that way. So another piece of advice for you is: don't worry too much about what you're going to be doing when you get out of business school - life will come your way.

Banks don't want certain asset classes, and that's created opportunities for private equity, hedge funds, Silicon Valley. In this case I think he was referring to some of the European banks shedding assets, and the big buyers are probably not going to be big American banks. Someone like Blackstone may have a very good chance to buy those assets, leverage them, borrow up a little bit, and do something good there.

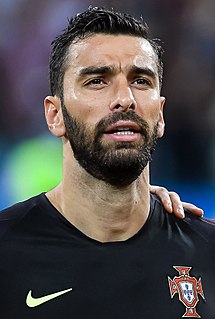

It's very different, because in Portugal we don't play during the Christmas holidays. But I think it's very good for the fans and everyone around, because families can enjoy the games together during the holidays. For my family, it's also good because they like to see me perform and they like to see my play.