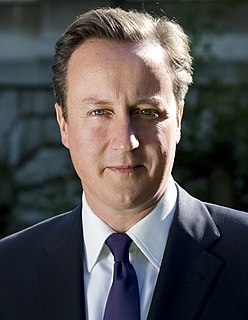

A Quote by David Cameron

There's another way we are getting behind business - by sorting out the banks. Taxpayers bailed you out. Now it's time for you to repay the favour and start lending to Britain's small businesses again.

Related Quotes

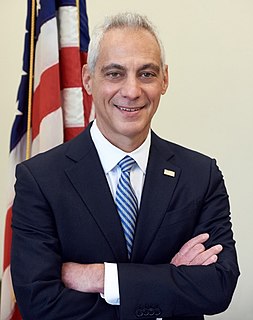

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

For example, the insurance industries and the big banks are absolutely euphoric now - on the business pages they don't even conceal it - because they've succeeded in coming out of the crisis even stronger than they were before, and in a better position to lay the basis for the next crisis. But they don't care, because they'll get bailed out again. That's class consciousness with a vengeance.

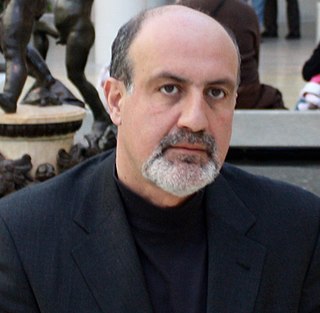

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

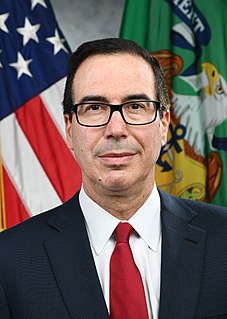

If you talk to anyone involved in business - forget banks and big business - talk to small businesses - do it yourself, don't ask me - they'll tell you it's crippling. Small-business formation is the lowest it has ever been in a recovery, and it's really for two reasons. One is regulations and the second is access to capital for people starting new businesses.

A lot of the philosophies of the businesses are just 'we're interested in getting customers now and if we're losing money with each customer now that's okay because we have this huge hoard of venture capital that we can subsidise the operation with and once we have the required number of tens of millions of customers and we drive our competitors out of business, then we can start to raise prices and become a proper business.'