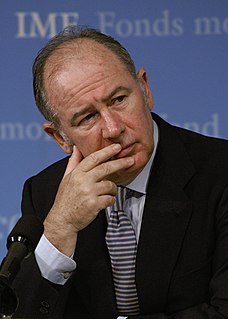

A Quote by David Cameron

I mean, I'm a conservative. I believe that, you know, if you borrow too much, you just build up debts for your children to pay off. You put pressure on interest rates. You put at risk your economy. That's the case in Britain. We're not a reserve currency, so we need to get on and deal with this issue.

Related Quotes

If you put Canada into $1.5 trillion in debt and interest rates go up just 200 basis points, you cannot provide the services to 36 million people that were guaranteed to them in the social contract they have with Canada. That's a very, very scary prospect. You can't burden this economy with that much debt. The risk you take on is insurmountable. You have to assume for the next 50 years that rates don't go up? That's insane. That's irresponsible. That's stupid.

Credit card companies are jacking up interest rates, lowering credit limits, and closing accounts - and people who have made timely payments are not exempt. So even if you pay off your balance - and that's tough when interest rates are insanely high - there's a good chance your credit limit will be slashed, and that will hurt your FICO score.

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.

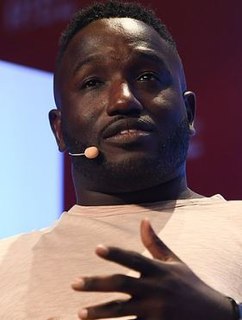

I do think, in any industry, when you put too much pressure on the source of your happiness coming from your work, you're going to run into a wall. It's easy to think that once you have success, then happiness will just hit like a wave over you. I don't think that's the case, or at least, when I achieved my first dream, that wasn't the case.

Whenever I eat at a restaurant I never put the napkin in my lap. People say, 'Hannibal, why don't you put the napkin in your lap?' Because I believe in myself. I believe in my ability to not spill food in my pants 'cause I'm a goddamn adult. And I've mastered the art of getting food from my plate to my mouth without messing up my jeans. You need to believe in yourself, too and get your life together, that's for babies. Have some confidence in your eating abilities and hand/eye coordination.

You don't pay back your parents. You can't. The debt you owe them gets collected by your children, who hand it down in turn. It's a sort of entailment. Or if you don't have children of the body, it's left as a debt to your common humanity. Or to your God, if you possess or are possessed by one. The family economy evades calculation in the gross planetary product. It's the only deal I know where, when you give more than you get, you aren't bankrupted - but rather, vastly enriched.

Can you know you can have institutions that put curbs on that in various ways, and actually what the banks, you know, they have various capital ratios and that sort of thing, but the banks got around them, I mean, they set up sieves and that sort of thing just to get more leverage. People love leverage when it's working. I mean, it's so easy to borrow money from a guy at X and put it out at X.

Government, possessing the power to create and issue currency and credit as money and enjoying the right to withdraw both currency and credit from circulation by taxation and otherwise, need not and should not borrow capital at interest as a means of financing government work and public enterprises.