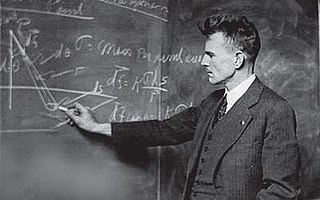

A Quote by David Frum

One of the great drivers of the alienation that has made Donald Trump possible is that the growth in the American economy has been weak. In the decade from 2005 to 2015, there was not one year when the US hit three per cent growth. And to the extent there's been growth, virtually all of it has been collected by the top 10 per cent of the population. Obviously, if we knew how to make growth faster, we would. We don't. And it's very difficult to make growth more broadly shared. Because it's not just the US that has this problem.

Related Quotes

Health care is in as bad a shape as it has ever been after eight years of Barack Obama and the Democrat Party running it and running the US economy. It's an absolute disaster. Other areas of the economy are a disaster. Economic growth? There isn't any. It's 1% per quarter, a 4% growth rate per year if we're lucky. There is no expansion. There is no productivity increase.

The growth of the American food industry will always bump up against this troublesome biological fact: Try as we might, each of us can only eat about fifteen hundred pounds of food a year. Unlike many other products - CDs, say, or shoes - there's a natural limit to how much food we each can consume without exploding. What this means for the food industry is that its natural rate of growth is somewhere around 1 percent per year - 1 percent being the annual growth rate of American population. The problem is that [the industry] won't tolerate such an anemic rate of growth.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

To put it in context, the federal government was, at the beginning [of the Vancouver meeting], talking about a $15-per-tonne floor for carbon emissions. We're at $30 a tonne, so we're already double that. But our economy is growing at a faster rate - three per cent of GDP is our projected growth in British Columbia.

Growth, growth, growth -- that's all we've known . . . World automobile production is doubling every 10 years; human population growth is like nothing that has happened in all of geologic history. The world will only tolerate so many doublings of anything -- whether it's power plants or grasshoppers.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

Every major industry was once a growth industry. But some that are now riding a wave of growth enthusiasm are very much in the shadow of decline. Others that are thought of as seasoned growth industries have actually stopped growing. In every case, the reason growth is threatened, slowed, or stopped is not because the market is saturated. It is because there has been a failure of management.

If we had 3 percent growth, which is what we're trying to get to, what we're at, by the way, right now, we're trying to maintain that 3 percent growth. If we had been at 3 percent growth over the last ten years, the budget very nearly would be balanced in 2017. That's how big a difference it makes when you grow the American economy that additional 1 percent over ten years.

A combination of very rapid population growth over the last 50 years and reckless economic growth during the same time has stored up massive problems for societies the world over. No nation is immune. The scientific evidence tells us all we need to know: carry on with business-as-usual growth-at-all-costs, and we're stuffed