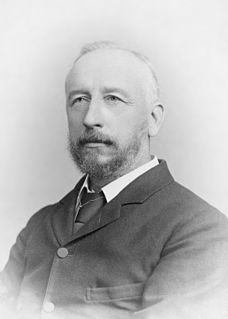

A Quote by David Gill

Related Quotes

I know what it's like being with a major label. But I've always wanted to do things differently. And when I found out that the internet was a digital medium that could transfer binary code, the 0s and 1s - which is what a CD is - I knew it was only a matter of time before the feed would be fast enough to transfer files.

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.