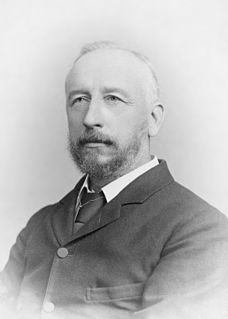

A Quote by David Gill

The rolling contract was designed to specifically take away some of that retirement talk and retirement issue.

Quote Topics

Related Quotes

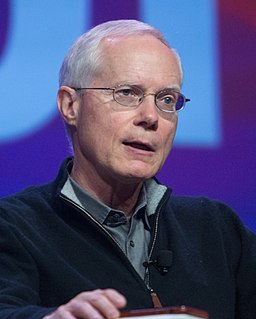

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

You can look at history of these things, and Social Security wasn't devised to be a system that supported you for a 30-year retirement after a 25-year career... So there will be things that, you know, the retirement age has to be changed, maybe some of the benefits have to be affected, maybe some of the inflation adjustments have to be revised.

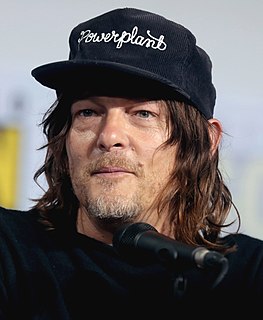

If we stop believing in a future, if we stop doing things for something else but start doing them for now, some fundamental things change. Retirement becomes less about how much money you can squirrel away now and much more a matter of participating and contributing to your own community now so that they want to take care of you. … We’re going to move into a world where your retirement will be more secure if you’ve made lots of friends with young people rather than collected lots of dollars.

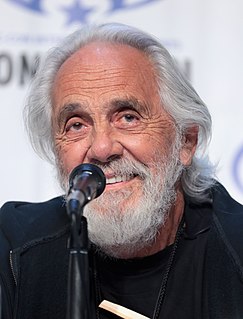

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.