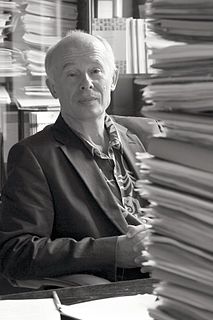

A Quote by David Graeber

States created markets. Markets require states. Neither could continue without the other, at least, in anything like the forms we would recognize today.

Related Quotes

There are markets extending from Mali, Indonesia, way outside the purview of any one government which operated under civil laws, so contracts weren't, except on trust. So they have this free market ideology the moment they have markets operating outside the purview of the states, as prior to that markets had really mainly existed as a side effect of military operations.

The full consequences of a default or even the serious prospect of default by the United States are impossible to predict and awesome to contemplate. Denigration of the full faith and credit of the United States would have substantial effects on the domestic financial markets and on the value of the dollar in exchange markets. The Nation can ill afford to allow such a result. The risks, the cost, the disruptions, and the incalculable damage lead me to but one conclusion: the Senate must pass this legislation before the Congress adjourns.

It is one of the most fatal illusions that, by substituting negotiations between states or organized groups for competition for markets or for raw materials, international friction would be reduced. This would merely put a contest of force in the place of what can only metaphorically be called the "struggle" of competition and would transfer to powerful and armed states, subject to no superior law, the rivalries which between individuals had to be decided without recourse to force.

The United States as we know it today is largely the result of mechanical inventions, and in particular of agricultural machinery and the railroad. One transformed millions of acres of uncultivated land into fertile farms, while the other furnished the transportation which carried the crops to distant markets.

Either the Earth System would undergo major phase transitions as a result of unchecked human pressure on nature's capacities and resources or a "Great Transformation" towards global sustainability would be initiated in due course. Neither transitions nor transformations will be manageable without novel forms of global governance and markets.

Private equity capital in each of those markets Europe and Asia - while those markets have very different characteristics - fills a niche where either strategic investors or the public markets don't go, or don't want to go for some particular reason. I think that's going to continue to be the case going forward.

Allowing an independent and sovereign Iraq could be a nightmare for the United States. It would mean that it would be Shi'ite-dominated, at least if it's minimally democratic. It would continue to improve relations with Iran, just what the United States doesn't want to see. And beyond that, right across the border in Saudi Arabia where most of Saudi oil is, there happens to be a large Shi'ite population, probably a majority.