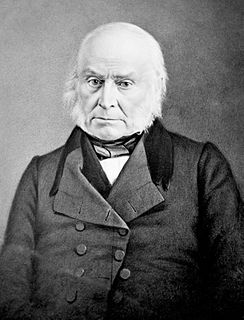

A Quote by David Hume

The most pernicious of all taxes are the arbitrary.

Quote Topics

Related Quotes

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

New and expanded refundable tax credits would raise the fraction of taxpayers paying no income taxes to almost 50% from 38%. This is potentially the most pernicious feature of the president's budget, because it would cement a permanent voting majority with no stake in controlling the cost of general government.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

The starting point and the ending point are nothing but two arbitrary choices. You make them as in soccer games, where they chose that it's 90 minutes, not less and not more. But the choices are the responsibility of the filmmaker. You have to choose to join the story at an arbitrary point, and you leave it at an arbitrary point.

The most sinister of all taxes is the inflation tax and it is the most regressive. It hits the poor and the middle class. When you destroy a currency by creating money out of thin air to pay the bills, the value of the dollar goes down, and people get hit with a higher cost of living. It's the middle class that's being wiped out. It is most evil of all taxes.