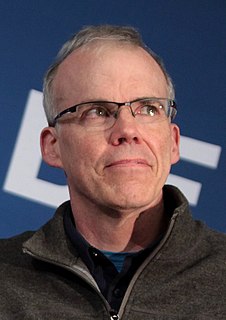

A Quote by David Korten

We should be moving toward local currencies not global or European currencies.

Related Quotes

Complementary currencies work in addition to existing money, rather than replacing existing, official money. There are whole different families of complementary currencies. One of them is local currencies. One is regional currencies. Another is functional currencies. Another is social-purpose currencies.

The IRS issued guidance for virtual currencies on March 25, 2014 that stated virtual currencies, including Bitcoin, are to be treated as property for federal tax purposes. This requires capital gains on virtual currencies to be recorded and reported. The Bitcoin Foundation says this could lead to unrealistic reporting.

The mark of a single currency is not only that all other currencies must be extinguished but that the capacity of other institutions to issue currencies must also be extinguished...In the case of the United Kingdom, that would involve Parliament binding its successors in a way that it has hitherto regarded as unconstitutional.

Bitcoin has been described as a decentralized, peer-to-peer virtual currency that is used like money - it can be exchanged for traditional currencies such as the U.S. dollar or used to purchase goods or services, usually online. Unlike traditional currencies, Bitcoin operates without central authority or banks and is not backed by any government.