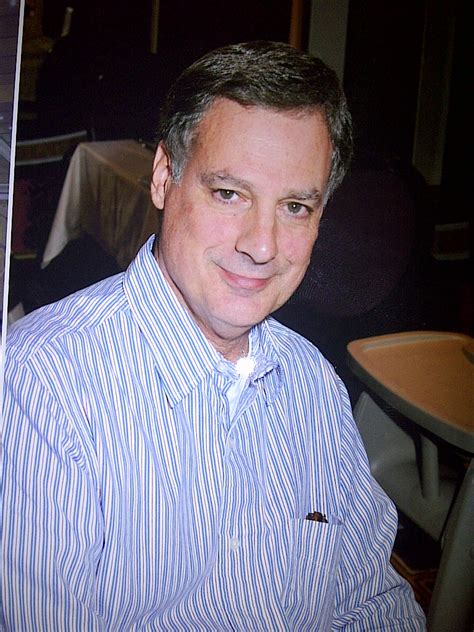

A Quote by David Lereah

With sales stabilizing, we should go back to positive price growth early next year.

Related Quotes

After careful consideration, we have decided that for our next fiscal year, we'll issue guidance on comparable store used unit sales and on earnings per share only for the full fiscal year. We will no longer issue quarterly guidance. This decision reflects our continuing focus on longer-term store, sales, and earnings growth and on return on invested capital, and our recognition that the performance in shorter-term periods can be more volatile than over the longer term. As we report our quarterly results, we plan to comment on how our performance is tracking against our annual guidance.

Year after year, we have had to explain from mid-year onwards why the global growth rate has been lower than predicted as little as two quarters back. This pattern of disappointment and downward revision sets up the first, and the basic, challenge on the list of issues policymakers face in moving ahead: restoring growth, if that is possible.

When I announced on my Facebook page that I'm coming to Israel, people started telling me that I shouldn't go there, but I figured that if I'm not going to come here, then I guess I can't go back to the United States anymore and I can never go to Russia again and I should probably never go back to Germany and I should probably never go back to France and I should probably never go back to England....All I see here is a really beautiful city.

advance money is really a delusion, that is to say, I get no more until it is paid out in sales, but still, living from hand to mouth and day to day as I do, a nickel in the hand is more useful than the same nickel next year. What do I know about next year? I've never been there. I don't know any one who has.