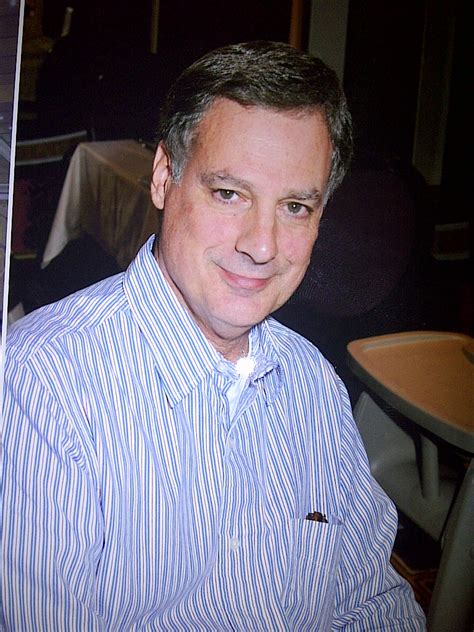

A Quote by David Lereah

If you paid your mortgage off, it means you probably did not manage your funds efficiently over the years.

Related Quotes

We paid for this instead of a generation of health insurance, or an alternative energy grid, or a brand-new system of roads and highways. With the $13-plus trillion we are estimated to ultimately spend on the bailouts, we could not only have bought and paid off every single sub-prime mortgage in the country (that would only have cost $1.4 trillion), we could have paid off every remaining mortgage of any kind in this country - and still have had enough money left over to buy a new house for every American who does not already have one.

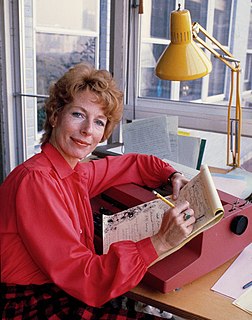

I live in a Spanish-style hillside home in Los Angeles, California. I paid $900,000 in 1995. It's perhaps worth about $3m now. Thankfully, I paid off my mortgage before the crash because I could see it coming. I worried that I would be caught having to pay off a very high mortgage for a house I couldn't sell.

Work - get paid; don't work - don't get paid. Everybody is on commission, .. Try not coming to work for six weeks. Work gets paid; don't work, don't get paid. When they earn those dollars, and when you're 4, and you clean up your room, it really means mom cleaned up the room and you did two toys. When you're 14, it means you cleaned up your room. But still, we got the money caused by work, and then, we have teachable moments on how to handle the money they earn.

When you move off a point of power, pay all your obligations on the nail, empower all your friends completely and move off with your pockets full of artillery, potential blackmail on every erstwhile rival, unlimited funds in your private account and the addresses of experienced assassins and go live in Bulgravia and bribe the police.