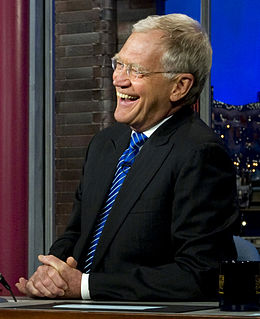

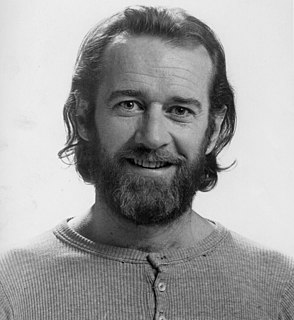

A Quote by David Letterman

President Bush says he now wants to simplify the tax code. Only those in the blue states will pay.

Related Quotes

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

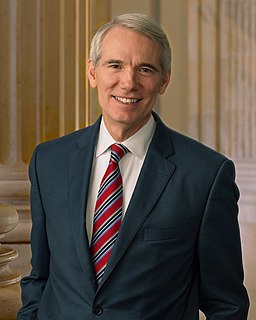

I think that taxes would be fair if we first get rid of the tax code. This is the ultimate solution, not to just say we're going to trim around the edges, not to say that we will try to simplify a little of this and a little of that. The problem is, replace the tax code, so we can establish tax fairness for everybody.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

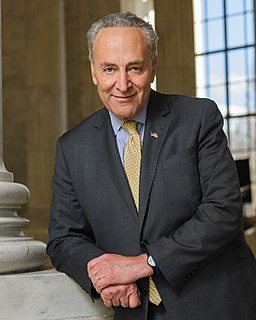

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

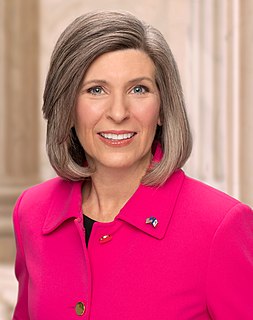

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.