A Quote by David Malpass

The assumption that Washington could and would resolve Lehman Brothers without a bankruptcy, as it had Bear Stearns, was the single biggest mistake in the series of mistakes in 2007 and 2008 that led to the financial panic and the ensuing epidemic of job losses.

Related Quotes

In September 2008 - as Lehman Brothers filed for bankruptcy and AIG, the world's biggest insurance company, accepted a federal bailout - Senator John McCain of Arizona, in what was widely viewed as a political move, suspended his presidential campaign and called on Obama to rush back to Washington for a bipartisan meeting at the White House.

I mean there is no capital requirements to it or anything of the sort. And basically, I said there were possibly financial weapons of mass destruction, and they had them. They destroyed AIG. They certainly contributed to the destruction of Bear Sterns and Lehman. Although Lehman had other problems, too.

The toughest are people mistakes, when you put the wrong person in a job. Sometimes you're too slow to move them out. Or not getting the right people involved to solve a problem, or doing something out of anger; you learn, just don't do that. But I'd have to say the Whale was one of them, and I would also have to put Bear Stearns and Washington Mutual on the list at this point.

American business would be run better today if there was more alignment between CEOs' interest and the company. For example, would the financial crisis of 2008 have occurred if the CEO of Lehman and Morgan Stanley and Goldman and Citibank had to take a very small percentage of every mortgage-backed security... or every loan they made?

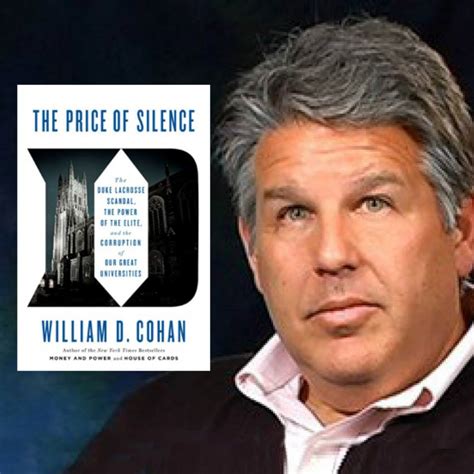

The dirty little secret of what used to be known as Wall Street securities firms-Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns-was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty-four hours away from a funding crisis. The key to day-to-day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.