A Quote by David Ricardo

In stating the principles which regulate exchangeable value and price, we should carefully distinguish between those variations which belong to the commodity itself, and those which are occasioned by a variation in the medium in which value is estimated, or price expressed.

Related Quotes

The value of any commodity, therefore, to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities. The real price of everything, what everything really costs to the man who wants to acquire it, is the toil and trouble of acquiring it.

Man is more than his environment. It is from the innate quality of the Spirit in him, his inner storehouse, that he draws those ideas, his intuitions, which unify his perceptions of the external world instantaneously with a value which is qualitative and not quantitative, and which he embodies in the works of his culture - those achievements which belong not only to one particular time but to all times, and mark the path of his upward progress.

Over two thousand years ago, Aristotle taught us that money should be durable, divisible, consistent, convenient, and value in itself. It should be durable, which is why wheat isn't money; divisible which is why works of art are not money; consistent which is why real estate isn't money; convenient, which is why lead isn't money; value in itself, which is why paper shouldn't be money. Gold answers to all these criteria.

Economists tell us that the 'price' of an object and its 'value' have very little or nothing to do with one another. 'Value' is entirely subjective economic value, anyway while 'price' reflects whatever a buyer is willing to give up to get the object in question, and whatever the seller is willing to accept to give it up. Both are governed by the Law of Marginal Utility, which is actually a law of psychology, rather than economics. For government to attempt to dictate a 'fair price' betrays complete misunderstanding of the entire process.

LABOUR, like all other things which are purchased and sold, and which may be increased or diminished in quantity, has its natural and its market price. The natural price of labour is that price which is necessary to enable the labourers, on with another, to subsist and to perpetuate their race, without either increase or diminution.

In the kingdom of ends everything has either a price or a dignity. Whatever has a price can be replaced by something else as its equivalent; on the other hand, whatever is above all price, and therefore admits of no equivalent, has a dignity. But that which constitutes the condition under which alone something can be an end in itself does not have mere relative worth, i.e., price, but an intrinsic worth, i.e., a dignity.

[W]e think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value -- in the hope that it can soon be sold for a still-higher price -- should be labeled speculation (which is neither illegal, immoral nor -- in our view -- financially fattening).

There are all sorts of institutions in the economic world which depart from the simple price/market model which I worked on in an earlier incarnation and which has been sort of the mainstream of economic theories since Adam Smith and David Ricardo. There are all sorts of contractual relations between firms and individuals which do not conform to the simple price theory - profit-sharing schemes and so forth - and the explanation for these suddenly became clear. We now understand why these emerged and that they are based on differences in information in the economy.

To estimate the value of Newton's discoveries, or the delight communicated by Shakespeare and Milton, by the price at which their works have sold, would be but a poor measure of the degree in which they have elevated and enchanted their country; nor would it be less grovelling and incongruous to estimate the benefit which the country has derived from the Revolution of 1688, by the pay of the soldiers, and all other payments concerned in effecting it.

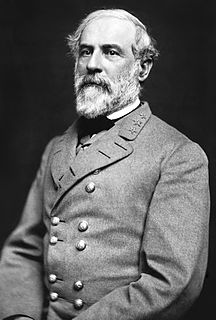

Everyone should do all in his power to collect and disseminate the truth, in the hope that it may find a place in history and descend to posterity. History is not the relation of campaigns and battles and generals or other individuals, but that which shows the principles for which the South contended and which justified her struggle for those principles.