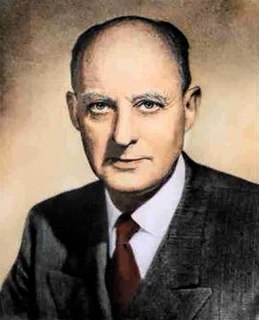

A Quote by David Ricardo

During the period of capital moving from one employment to another, the profits on that to which capital is flowing will be relatively high, but will continue so no longer than till the requisite capital is obtained.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

The idea that the profits of capital are really the rewards of a just society for the foresight and thrift of those who sacrificed the immediate pleasures of spending in order that society might have productive capital, had a certain validity in the early days of capitalism, when productive enterprise was frequently initiated through capital saved out of modest incomes.

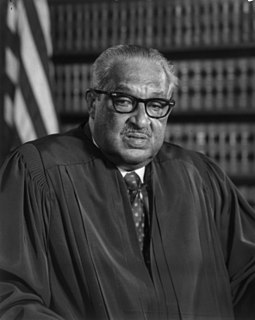

When in Gregg v. Georgia the Supreme Court gave its seal of approval to capital punishment, this endorsement was premised on the promise that capital punishment would be administered with fairness and justice. Instead, the promise has become a cruel and empty mockery. If not remedied, the scandalous state of our present system of capital punishment will cast a pall of shame over our society for years to come. We cannot let it continue.

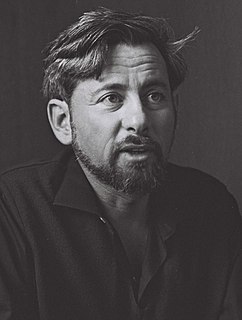

The solution is this: There will be a state of Palestine in all of the Occupied Territories of the West Bank and the Gaza Strip. The Green Line, the border that existed before 1967, will come into being again. Jerusalem will be the shared capital - East Jerusalem will be the capital of Palestine, West Jerusalem will be the capital of Israel. All settlements must be evacuated. The security must be arranged for both people, and there must be a moral solution and a practical solution.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.