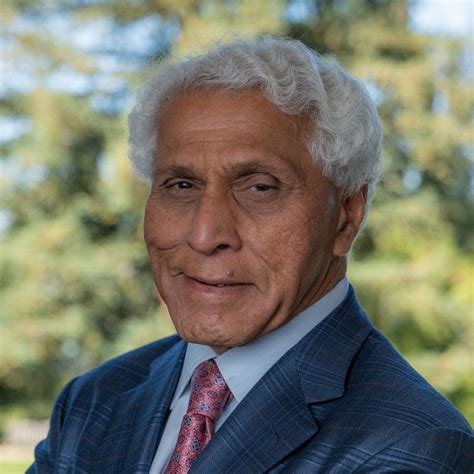

A Quote by David Rubenstein

It's clear to me when you do private equity well, you're making companies more efficient and helping them grow and become more profitable. That success means our investors - such as public pension funds - benefit, which contributes to the economic wealth of society.

Related Quotes

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

We might as well expect to grow trees from leaves as hope to build up a civilization or a manhood without taking into consideration our women and the home life made by them, which must be the root and ground of the whole matter. Let our girls feel that we expect something more of them than that they merely look pretty and appear well in society. Teach them that there is a race with special needs which they and only they can help; that the world needs and is already asking for their trained, efficient forces.

Imagine if the pension funds and endowments that own much of the equity in our financial services companies demanded that those companies revisit the way mortgages were marketed to those without adequate skills to understand the products they were being sold. Management would have to change the way things were done.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.