A Quote by David Stockman

I think everybody in this generation, and I'm the leading edge of the baby boom - I was born in 1946 - has benefitted from a 30-year explosion of debt, which created temporary but unsustainable economic prosperity and a financialization of the system through lower, and lower, and lower interest rates that has created massive rewards to speculation but not real investments so I benefitted from it. Almost everyone who has been in the market has benefitted but they didn't earn it.

Quote Topics

Almost

Baby

Baby Boom

Been

Boom

Born

Created

Debt

Earn

Economic

Economic Prosperity

Edge

Everybody

Everyone

Explosion

Generation

Interest

Interest Rate

Interest Rates

Investments

Leading

Lower

Market

Massive

Prosperity

Rates

Real

Rewards

Speculation

System

Temporary

Think

This Generation

Through

Unsustainable

Which

Year

Related Quotes

I think everybody benefitted from what I am calling a bubble finance system, a bubble economy and if we're ever going to right the system, we're going to have to stop this explosion of the federal debt. We need huge spending cuts, OK? Don't get me wrong, we need to raise regular taxes too but even beyond that it's not going to hurt if we want to reset the system to ask those who have benefitted disproportionately - remember, we got $60 trillion of net worth in the household sector. $45 trillion of that belongs to the top 5 percent.

The benefits of a modest warming would outweigh the costs - by $8.4 billion a year in 1990 dollars by the year 2060, according to Robert Mendelsohn at Yale University - thanks to longer growing seasons, more wood fiber production, lower construction costs, lower mortality rates, and lower rates of morbidity (illness).

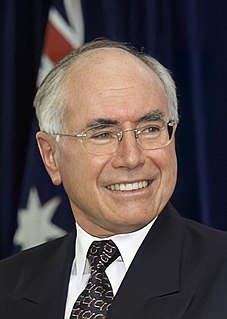

I have had the view that cutting wages is not the path to prosperity, and one of the great myths propagated about my attitude to industrial relations is that I believe in lower wages. I've never believed in lower wages. Never. Never believed in lower wages, I've never believed in lower wages as an economic instrument.