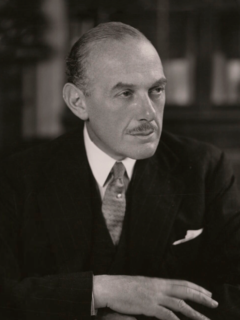

A Quote by David Talbot

EFR entered into an agreement to sell some noncore assets for $2.05M.

Related Quotes

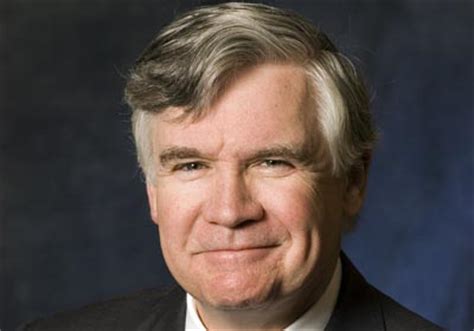

[In Mexico] they have a VAT tax. We're on a different system. When we sell into Mexico, there's a tax. When they sell in - automatic, 16 percent, approximately. When they sell into us, there's no tax. It's a defective agreement. It's been defective for a long time, many years, but the politicians haven't done anything about it.

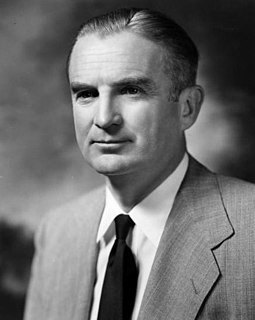

The reason the world is in the spot it's in is because North Korea entered into an agreement and then did not keep up their terms of the agreement. They received aid in return for promising not to develop nuclear weapons. They took the aid, they ran with the aid and then they developed a nuclear weapons anyway.

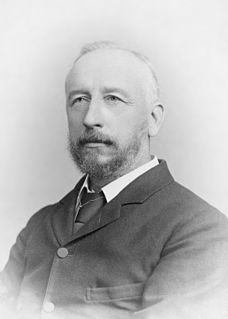

Resolution Trust Company was set up to liquidate a bunch of assets that the government had inherited because the savings and loans went broke. So the savings and loans went broke, the government stepped in, paid off depositors, and now they're left with this mass of assets to sell. We're not talking about selling here, we're talking about buying intelligently. They were selling what they got handed to them by a bunch of savings and loan operators that had in many cases had done some very dumb thing. But their job was to liquidate it. And they liquidated.