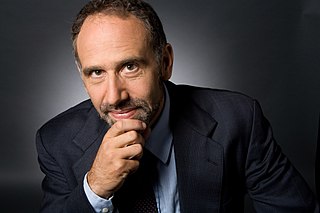

A Quote by Dean Baker

I don't think "Reganomics" will ever fully end. I mean, Reaganomics, to put it simply, was trying to get low taxes for wealthy people. And wealthy people are still there pushing for low taxes.

Related Quotes

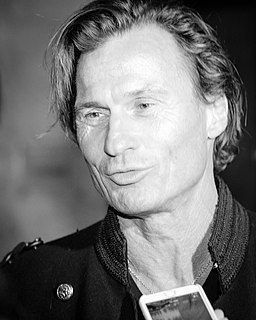

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

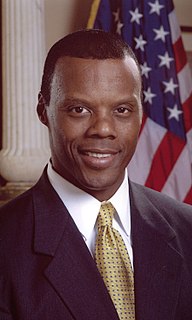

The growing inequality of wealth and income distribution is both a moral and economic problem. If the wealthy are unwilling to pay more taxes, then this is going to lead to spending cuts. And if you put off the table things like national defense, then you're going to end up cutting more and more out of programs that aid the poor. So, I think there are consequences to this idea that tolerance for inequality requires us to - to just do nothing to make the wealthy contribute a higher share of resources to fund the government.

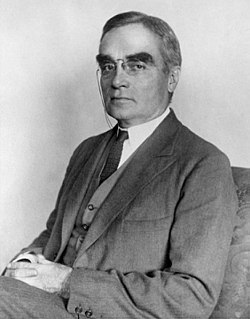

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.