A Quote by Deng Xiaoping

There is oil in the Middle East there is rare earth in China.

Related Quotes

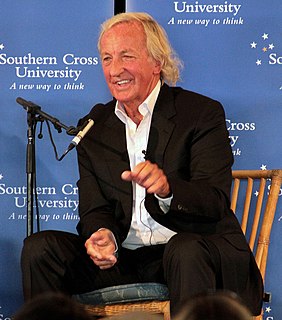

I think the public is very reluctant to get involved in more foreign wars, especially in the Middle East. And they understand, implicitly, that we go to war in the Middle East because of oil. And if we don't want to go to war in the Middle East, then we have to do something about the oil problem. And I think that view is gaining ground in the U.S.

Israel is the American watchdog in the Middle East, and that's why the Palestinians remain victims of one of the longest military occupations. They don't have oil. If they were the Saudis, they wouldn't be in the position they are now. But they have the power of being able to upset the imperial order in the Middle East.

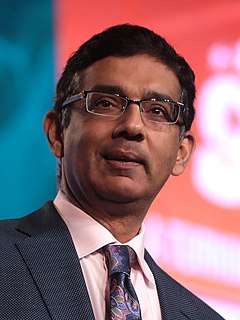

Historically, the argument is we stole the country from the Indians. America stole the labor of African Americans for over 200 years under slavery. America took half of Mexico by force in the Mexican War. American foreign policy, the progressives say it's based on theft. Why? Because look, America is very active in the Middle East. Why? The Middle East has oil. Notice that America doesn't get involved in Haiti or Rwanda because they don't have any oil.

Oil remains fundamentally a government business. While many regions of the world offer great oil opportunities, the Middle East with two-thirds of the world's oil and the lowest cost, is still where the prize ultimately lies, even though companies are anxious for greater access there, progress continues to be slow.

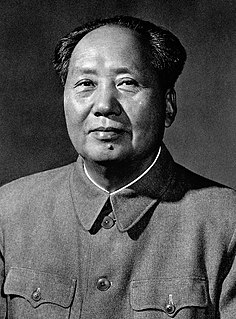

The BRIC countries - Brazil, India, China, Turkey, South Africa, Indonesia even, and Russia - are now new actors. Over the last eight years, China multiplied by seven its economic presence and penetration in the Middle East. And if this happens on economic terms and there is a shift towards the East, the relationship between these countries and Israel is completely different from the United States. And it means that the challenges are going to be different, because China is not supporting Israel the way the U.S. are supporting Israel.

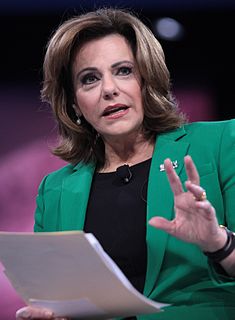

Even if America tomorrow - and it won't happen overnight - but if we did reduce our demand for gas and natural gas and crude oil by a significant degree, that does have an exponential effect on producers in the Middle East, everything else being equal. But if China's demand is growing and India's demand is growing, they are not going back.

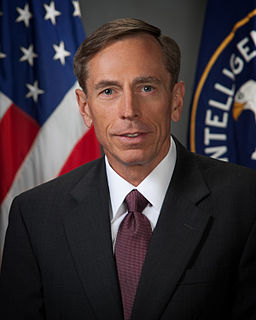

Oil is a tangible commodity, so there is a global market. The fact that we may need less may affect the global price because we're big consumers: we probably take about a quarter of global demand. But if suddenly, let's just use a crazy example, fighting in the Middle East led to the closure of the Strait of Hormuz and no oil could get out through the Strait of Hormuz, well that would affect China, India, Europe, it will affect the whole global economy. It will affect us, too, then.