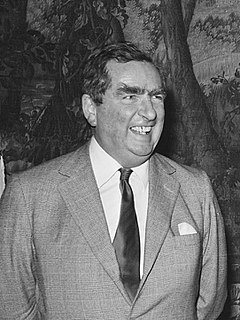

A Quote by Denis Healey

The difference between tax avoidance and tax evasion is the thickness of a prison wall.

Quote Topics

Related Quotes

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.