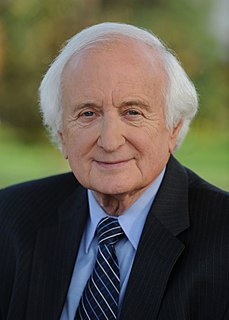

A Quote by Dennis Moore

What we should be trying to do is to encourage people to establish private retirement accounts and help them take pressure off the Social Security system.

Related Quotes

The majority of Latinos in this country are 28 years old or younger. All of those people out there attacking the Latino community, when you see a Latino going down the street with a baby carriage and a couple of children walking beside them, they should say 'Hey, there goes my social security and my Medicare.' Those are the people that are going to contribute to keep our social security system funded and our medical system funded.