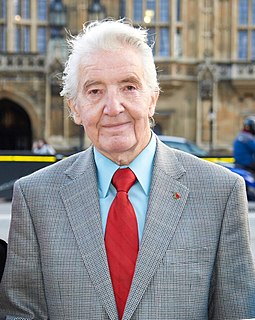

A Quote by Dennis Skinner

I solemnly swear that I will bear true and faithful allegiance to the Queen when she pays her income tax.

Related Quotes

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

She made a sound of regret. ‘We come second, you and I, Luc-ien,’ she said. ‘Our allegiance is always to our kingdoms. Without that allegiance, our people would fall.’ She placed her head back against his chest and he felt her tears. ‘This is not our time.’ ‘But that will never mean I love you less,’ he said.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

I am too sick to work and haven't money enough to last 2 months and pay income tax. I want to keep going but do not see quite how, and there is no alternative - rather than justify my mother's 25-year dread of my "coming back on her, sick," I must kill myself. If she has to pay funeral costs, at least she will cut them to the bone and I will not be here to endure her martyrdom and prolong it by living.