A Quote by Dev Anand

A very small proportion of the country's black money is in the movie industry. Because we are written about, public attention is focused on us. Do you think there is no black money in other businesses? With the exception of government servants and others who have tax deducted at source, there are tax evaders in every walk of life.

Related Quotes

One of the tax systems in the US is for wage earners. The government takes money from them out of each paycheck - so it knows how much they make, and those workers can't cheat to any significant degree. But the other tax system is for capital. Those with capital get to tell the government what they want to tell. They may get audited, but if their tax returns are of any size the government doesn't have enough of the smart auditors to figure out what's really going on. And there are the rules that allow you to do things like take in money today and pay taxes on it thirty years from now.

Let me have my tax money go for my protection and not for my prosecution. Let my tax money go for the protection of me. Protect my home, protect my streets, protect my car, protect my life, protect my property...worry about becoming a human being and not about how you can prevent others from enjoying their lives because of your own inability to adjust to life.

Look, I'm very much in favor of tax cuts, but not with borrowed money. And the problem that we've gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don't think we can play subtle policy here.

Once money goes into a charity, it is tax exempt, so that's a benefit you get. And in return, you have to use the assets of the charity to serve the public good. So if Trump is using this money basically to save his businesses, the money isn't helping people. That's a violation of the letter and the spirit of law.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

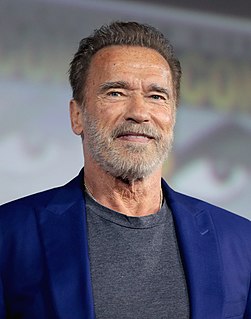

I think every filmmaker in Europe would be lying if they didn't say one day they just wanted to make a movie here in Hollywood or at least try it. It's very different from European filmmaking, because here it's like a real industry. It's very much about money and making money, which I think is fine, because it's very expensive to make movies.