A Quote by Dick Armey

Related Quotes

Of course, our immigration system isn't broken. The enforcement of our immigration system is broken. The president Barack Obama, the Democrat Party, and several in the Republican Party are trying to break the immigration system. The system itself is not broken; it's just fine. It's just being ignored.

Taxing Women is a must-have primer for any woman who wants to understand how our current tax system affects her family's economic condition. In plain English, McCaffery explains how the tax code stacks the deck against women and why it's in women's economic interest to lead the next great tax rebellion.

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.

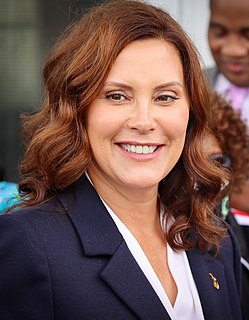

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.

I believe we're at the verge of the greatest time to be alive in this world. But Washington is holding us back. How we tax, how we regulate. We're not embracing the energy revolution in our midst, a broken immigration system that has been politicized rather than turning it into an economic driver. We're not protecting and preserving our entitlement system or reforming for the next generation. All these things languish while we have politicians in Washington using these as wedge issues.

What I really think is that our current model of copyright is fundamentally broken. We badly need to replace it with a different system for remunerating creators, which gets it the hell out of the face of the public (who were never aware of it to begin with in the pre-internet dead tree era). Unfortunately, the current copyright model is enshrined in international trade treaty law, making it almost impossible to work around.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.