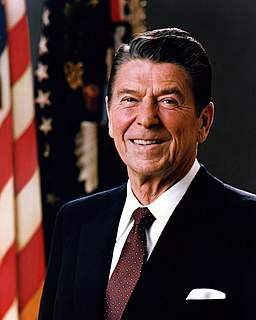

A Quote by Dick Morris

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.

Quote Topics

About

Administration

Also

Average

Become

Charitable

Contributions

Course

Deductions

Earner

Effective

Hike

His

Income

Income Tax

Interest

Johnson

Just

Known

Local

Lyndon Johnson

Mortgage

Most

Nation

Notable

Obama

One-Third

Percent

Plans

Poverty

President

President Lyndon Johnson

President Obama

Prosperity

Raising

Rate

Speaking

State

Taxes

Third

Top

War

War On Poverty

Wealthy

Whether

Will

Related Quotes

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

Obama wants to take the individual small business tax to 44 percent, and the corporate rate - he says - down to 28 percent or whatever. But that really damages the small businesses. And it doesn't make us competitive. You got to take them both down to 20, because state and local corporate taxes are 5 percent.

The bottom quarter of the human population has only three-quarters of one percent of global household income, about one thirty-second of the average income in the world, whereas the people in the top five percent have nine times the average income. So the ratio between the averages in the top five percent and the bottom quarter is somewhere around 300 to one - a huge inequality that also gives you a sense of how easily poverty could be avoided.

Up until 1986, the top marginal rate, the top statutory rate was 50 percent. Now it's 35 percent. And all the pressure is on to lower that even further. And this just doesn't make a great deal of sense. When people say, 'Oh, we can't raise taxes on the rich. They'll go on strike, they'll move to another country.' But within recent memory, it hasn't been that long ago that we had rates that were substantially higher. And these people did just fine. I just think that there's a disconnect between the facts of what taxes do and the sort of mythology of what they do.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

Government is taking 40 percent of the GDP. And that's at the state, local and federal level. President Obama has taken government spending at the federal level from 20 percent to 25 percent. Look, at some point, you cease being a free economy, and you become a government economy. And we've got to stop that.

According to the Tax Foundation, the average American worker works 127 days of the year just to pay his taxes. That means that government owns 36 percent of the average American's output-which is more than feudal serfs owed the robber barons. That 36 percent is more than the average American spends on food, clothing and housing. In other words, if it were not for taxes, the average American's living standard would at least double.