A Quote by Dick Thornburgh

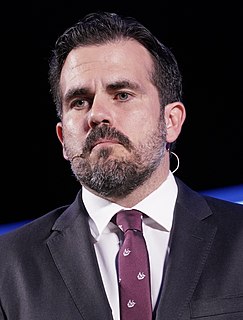

Yet, individuals and corporations in Puerto Rico pay no federal income tax.

Quote Topics

Related Quotes

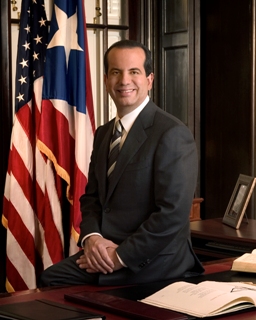

Puerto Ricans are U.S. citizens, but by their own choice, Puerto Rico is not a state. The relationship has worked well for Puerto Rico - which has strengthened its culture, language and economy - and for the United States, which has helped create in Puerto Rico a showcase of democracy and prosperity for all of Latin America.

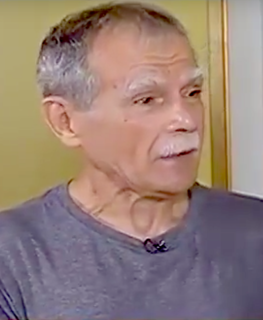

I believe that the overwhelming majority of Puerto Rico wants to be Puerto Ricans. I have been in five different states in the United States, and I have found young Puerto Ricans in the states who really love Puerto Rico, who really want to do something for Puerto Rico. And for me, Puerto Rico has to be the promised land of all Puerto Ricans, whether we are in the United States or wherever we are at. But this has to be the promised land. Annexation will never be the answer.

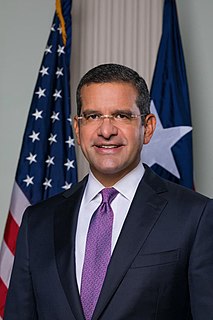

The truth of the matter is that we are being very aggressive, so that we can lay the foundations for investors to come to Puerto Rico, for jobs to be created, and for opportunities to ensue. And our objective, again, is for Puerto Rico, for the people of Puerto Rico who want to stay here, for them to have the opportunity to stay here.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

I hope people understand that when you tax corporations that the concrete and the steel and the plastic don't pay. People pay. And so when you tax corporations, either the employees are going to pay or the shareholders are going to pay or the customers are going to pay. And so corporations are people.

The overwhelming majority of Puerto Rico is completely, completely alienated from the political structure. Colonialism is really, really strong and alive in Puerto Rico. And the politicians have taken full advantage of that. We have a debt of $74 billion, caused primarily by the system and the political structure that exists in Puerto Rico.